Laminate flooring, once thedarlingof the industry, lost some of its luster years ago, observers say. Overshadowed by competing categoriesthat promised more in theway of design and performance, the category has struggled to maintain market share. However, the tide may be starting to turn.

Industry experts have posited that the seeming resurgence in laminate could be related to hardship currently facing its competition. Tariffs, for example, are again grabbing headlines as the thorn in the side of the industry’s fastest growing category. It’s no secret that resilient flooring is the powerhouse of the industry. For several years running, it has stolen marketshare fromother categories— including laminate—and remained the leading growth engine.

However, that doesn’t mean it’s immune to hardship. In November 2019, the U.S. Trade Representative (USTR) exempted much of the vinyl flooring category from the Section 301 tariffs that had greatly impacted it—the exemption was enacted in November 2019 and applied retroactively from Sept. 24, 2018 to Aug. 7, 2020. However, last month the USTR decided not to continue to include floor covering among items granted exemption, leaving many rigid LVT products exposed to the 25%tariff.

“The issue of U.S./China tariffs will go down as one of the hot topics in flooring and business in general— touching many, many industries,” said Derek Welbourn, CEO, Inhaus. “It’s certainly significant for flooring asit greatly effectsthe economics of flooring coming from China, including the most successful and one of the largest categoriesin hard surface flooring: LVT.”

While tariffs have impacted the resilient category in terms of pricing and convenience, laminate suppliers agree it isn’t really what’s put a charge in laminate sales of late. “We see that there is a general trend of laminate salesstrengthening, butthe tariffs are playing a veryminorrole in thistrend,”Welbourn noted.

John Hammel, director of hardwood and laminate category management for Shaw Floors, agreed, noting, “We don’t anticipate tariffs will impact laminate sales dramatically. However, laminate will remain a great choice for those needing a durable,water-resistantfloorthatisa more budget-friendly option.”

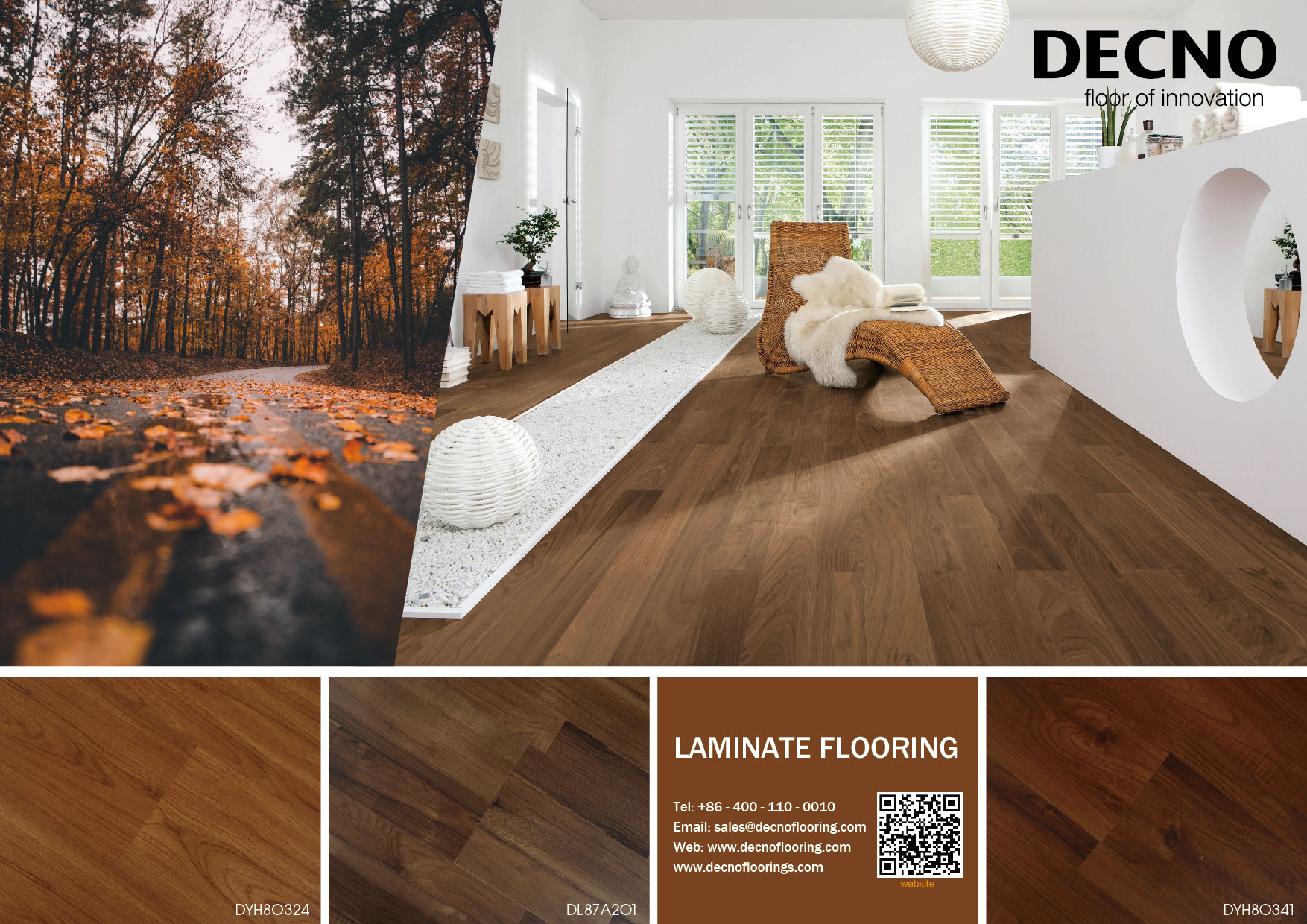

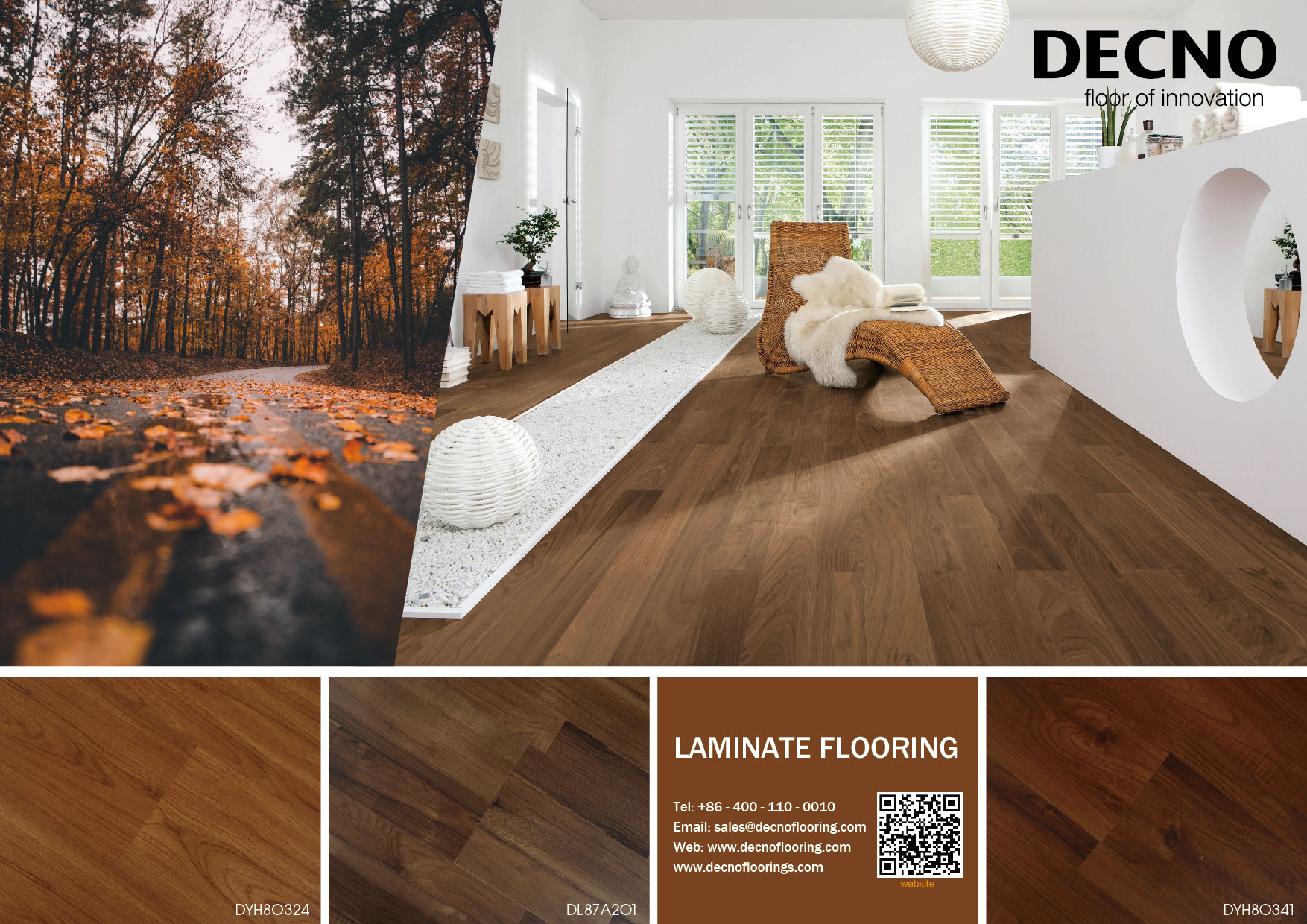

While Dan Natkin, vice president of laminate and hardwood, Mannington Mills, said the reinstatement of the tariffs will only help the Laminate poised to growshare amid tariff concerns, category advancements By Megan Salzano Inhaus’ Fruitville laminate features an oak wood-look design. category as its customers seek alternatives, he agreed that it’s laminate itself that is driving its success. “Tariffs aside, we have seen a resurging interest in the category over the past 18 months asretailersrecognize the multi-faceted performance of today’s laminate flooring,” he explained. “Not only are most highquality laminate flooring products at least moisture resistant, they also dramatically outperform LVT in terms oflong-termperformance.”

Most suppliers concur, thanks to new, rich visuals (see story on this page) and technologically advanced performance attributes, laminate is inching its way back into the hearts and minds of consumers and storefronts ofthe retail community.

Suppliers also note that while tariffs and other factors play a role, theoverallmarketstrategy isfocused on providing products that suit consumer interests. “While short-term dynamicssuch astariffs are a reality, ourstrategiesarebuiltonarelentless focus on customer needs,” explained SethArnold,VPofresidentialmarketing, Mohawk. “Tariffs will come and go,butcustomerswillalwaysbelooking for high-quality and innovative flooring. That’s why we offer a balanced portfolio of globally sourced and domestically manufactured products to help our customers provide solutionsto consumers.”

Some do note that heavy competition from categories such as resilient have actually been a boon to the category, motivating laminate producersto innovate.“The increased competition from LVT has actually benefited the laminate category asit has pushed the leading producers to innovate, creating even better laminate products, which were already pretty darn good,” Inhaus’ Welbourn said. “The result has been more efficient laminate production with products that offer greater innovations such as waterproof, easier installation and enhanced design.We feelthe retailers can benefit by learning the new attributes of laminate, which they can pass along to their clients. It’s an interesting time to have a quality laminate flooring program.”